The Australian Charities and Not-for-profits Commission (Commission) has announced new changes to the size thresholds for charities which will be effective from 1 July 2022. The new changes increase the threshold of what is considered a medium and large charity. It is expected the changes will reclassify many “medium” sized charities as “small” charities who will subsequently be required to only lodge an Annual Information Statement each year.

The new size thresholds

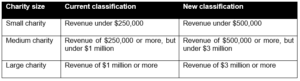

The Australian Charities and Not-for-profits Commission Act 2012 (Cth) (ACNC Act) classifies a charity’s size based on their annual revenue. The reporting obligations reflect the size of the charity. In short, the larger the charity, the more reporting obligations.

From 1 July 2022, the revenue threshold used to define the size of a charity will increase. A table comparing the current and new classifications can be seen below.

These changes will result in some charities previously classified as a “medium” charity being reclassified as “small”, subsequently reducing the charity’s reporting obligations. This means that when charities complete their 2022 Annual Information Statements, which for many, will cover the reporting period between 1 July 2021 and 30 June 2022, the new thresholds will take effect and newly classified small charities will now only be required to complete their Annual Information Statement in order to comply with their reporting obligations.

Reporting obligations

All charities regardless of size are required to lodge an Annual Information Statement.

In addition to lodging the Annual Information Statement, medium and large charities are required to lodge a financial report. Medium charities have the option to have their financial report reviewed or audited whereas large charities must have their reports audited. Further, medium and large charities will continue to have the choice between lodging a special purpose financial statement or a general-purpose financial statement. The submission of an annual financial report is optional for small charities.

Increased reporting obligations for large charities

While no changes have been made to the core reporting obligations, from the 2022 Annual Information Statement reporting period, large charities will be required to report remuneration paid to the charity’s responsible persons and senior executives in their Annual Information Statement and annual financial report.

New reporting obligations starting next year on 1 July 2023

In an effort to increase transparency of charities and identify circumstances of conflict of interest, starting 1 July 2023, all charities will be required to report their related party transactions in their Annual Information Statements. When charities complete their 2023 Annual Information Statements, which for many, will cover a reporting period between 1 July 2022 and 30 June 2023, all charities will need to declare when charity resources were used for the benefit of a close or related entity, instead of for the benefit of the charity’s beneficiaries and for charitable purposes.

Where to from here

Charities should consider how the new size thresholds will affect their reporting obligations this year. Large charities in particular should ensure they will be in a position to appropriately report key management personnel’s remuneration this year.

Additionally, all charities should be mindful about their future obligations to report their related party transactions starting from 1 July 2023, and should ensure they have the appropriate systems, processes and controls in place to capture these transactions in readiness for this upcoming reporting obligation.

If you have any questions regarding the changes and would like further information on how they will affect your charity, please do not hesitate to contact our Corporate Team for assistance.