Succession planning from a practical perspective for small and medium enterprises (SME). First things first, what is the status of the business? And what are the common business structures?

This is the first of an ongoing series of 10 articles on this topic.

10 ARTICLES TO ASSIST YOU IN HAVING A CONVERSATION, PREPARING AND SETTING UP A SUCCESSION PLAN

Business Structures

Choosing the correct structure at the outset is important, as it can be expensive to change once in place.

The following core issues need to be considered:

- Simplicity, cost of implementation and cost of ongoing administration

- Governance and management

- Tax

- Asset protection

- Sale

- Succession

It is becoming increasingly rare to find businesses structured as sole proprietorships and partnerships due to personal liability. In addition, on the death of a sole proprietor or partner, the business, or partnership share, falls into the estate of the deceased and can trigger tax consequences which may or may not be deferred, or covered by an exemption.

Businesses are more commonly structured as proprietary limited companies or discretionary family trusts, and often a number of these companies and trusts can be used to build a business structure designed to address and deal with many of the core issues above.

The Benefits & Limitations of Each Type of Entity Commonly Used

A proprietary limited company is a separate legal entity which can own assets, and contract in its own right. Income can be accumulated, or distributed via dividends.

Benefits:

- Simple and inexpensive to establish and administer.

- Simple to split governance (board directors) and management (employees).

- Income can be accumulated without penalty, taxed at the company tax rate (27.5% / 30%) and shareholders are entitled to offset tax paid by the company if the income can be distributed as a fully franked dividend.

- Limited liability for shareholders and directors, subject to directors’ duties and insolvent trading.

- Shares in the company form part of the estate of the shareholder.

- Shares are easily transferrable (shareholders can sell their shares without selling the business or assets) and shares confer fixed rights to votes, dividends and capital.

- Succession is simple through a gift of shares.

Limitations:

- No 50% CGT discount for appreciating assets.

- Non-assessable amounts from depreciation and write-off must be distributed as unfranked dividends or Division 7A compliant loans.

- Complications can be caused by Division 7A.

Within a discretionary family trust, the Trustee owns trust assets and distributes income and capital at their discretion to potential beneficiaries pursuant to the trust deed.

Benefits:

- Simple and relatively inexpensive to establish and administer. A trust can usually be amended relatively simply, for example to add or remove potential beneficiaries, or to add powers or provisions which may become necessary in circumstances not envisaged at the outset. Care must be taken however not to create a resettlement.

- The trust is managed on a day to day basis by the Trustee but is ultimately controlled, or governed, by the Appointor who has the power to remove and replace the Trustee. Corporate Trustees are often used to ensure continuity of asset ownership, which would not occur on death of an individual Trustee, and to limit personal liability in the event that a trust liability is incurred which is not indemnified or covered by trust assets.

- Income can be distributed and streamed flexibly and tax effectively between potential beneficiaries. Capital gains made by the trust can be reduced by the 50% discount and small business CGT concessions. Discretionary trusts are therefore beneficial for holding land and other assets which are likely to appreciate in value.

- Assets of the trust do not belong to any beneficiary, and therefore attract an increased level of asset protection.

- Control of the trust can pass in lifetime, or on death, through a gift of shares in the Corporate Trustee and nomination of a new Appointor.

Limitations:

- The entitlement of a potential beneficiary of the trust is not fixed, compared to the fixed entitlement of a shareholder of a company. A potential beneficiary cannot sell an interest in a discretionary trust, or deal with an Interest by Will on death.

- All trust income must be distributed or be taxed at the trust rate (47%).

- It can be difficult to utilise trust losses.

Benefits

- Asset protection through limited liability.

- Rights to income and capital can be fixed through ownership of units.

- Units are simple to transfer.

- CGT 50% discount can apply.

- Allows for external investors to be brought in.

- Can avoid some of the regulation associated with companies.

Limitations:

- Non distributed income is taxed at trust rate (47%).

- Non assessable amounts from building write-off and depreciation distributed to unit holders are potentially taxed under CGT event E4 which can be a problem if the unit trust is used to hold property.

- Transfer of units may attract stamp duty.

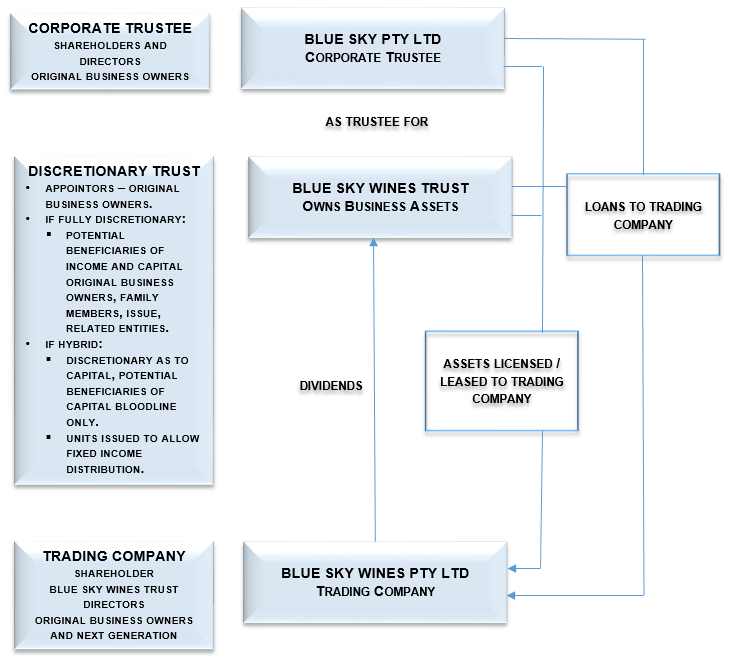

Example Asset Protection Structure

This is an example of a simple business structure commonly used. Many different combination structures can be used, depending on the particular circumstances and requirements of the business.

In this example,

- The business assets such as land, winery, trademarks and stock are owned by a discretionary family trust, with a Corporate Trustee, if appreciation is likely.

- A separate company is incorporated to trade. If claims arise in the trading company, the business assets are held by another entity and should be quarantined.

- The discretionary family trust owns the shares in the trading company. The dividends pass to the discretionary family trust, from where they can be distributed effectively at the discretion of the Trustee. If the trust is a hybrid trust, discretionary as to capital, but with units to fix income entitlement, the income will be distributed to the unitholders, whether individuals, or perhaps next generation discretionary family trusts.

- Succession is simply dealt with by a gift of the shares in the Corporate Trustee and nomination of an Appointor of the discretionary family trust.

- This structure can often be achieved through the use of CGT rollovers in stages.

This was originally published in Australian & New Zealand Grapegrower & Winemaker.

This Alert is intended as general information only. It does not purport to be comprehensive advice or legal advice. Readers must seek professional advice before acting in relation to these matters.